Bill raising sales tax cap passes CA Assembly

Although Californians already pay some of the highest sales taxes in the nation, a bill that recently passed the Assembly paves the way for the sales tax to go even higher. Assembly Bill 464 increases to 3 percent (from the current 2 percent cap) the maximum sales tax rate that can be levied by local governments.

Although Californians already pay some of the highest sales taxes in the nation, a bill that recently passed the Assembly paves the way for the sales tax to go even higher. Assembly Bill 464 increases to 3 percent (from the current 2 percent cap) the maximum sales tax rate that can be levied by local governments.

That potential 3 percent sales tax levied by cities and counties is in addition to the statewide 7.5 percent sales tax, which could result in a combined 10.5 percent tax in some areas of the state. Tax hikes require majority voter approval for general purpose levies and two-thirds approval for special purposes.

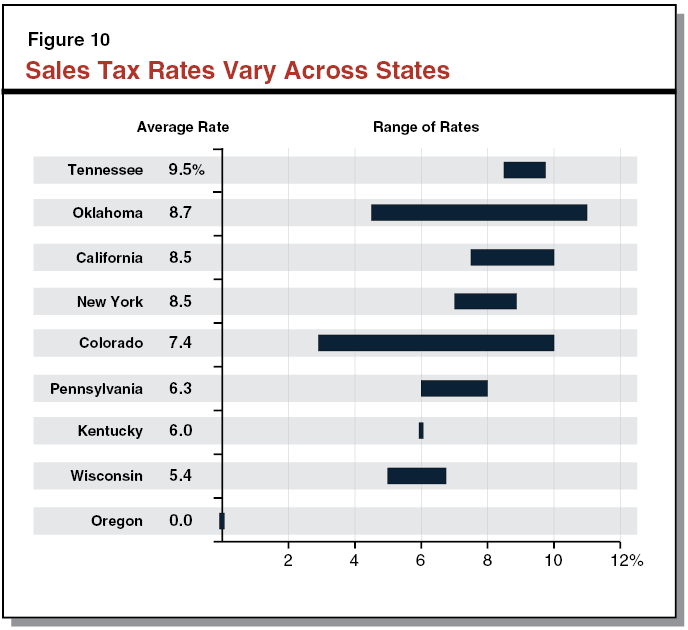

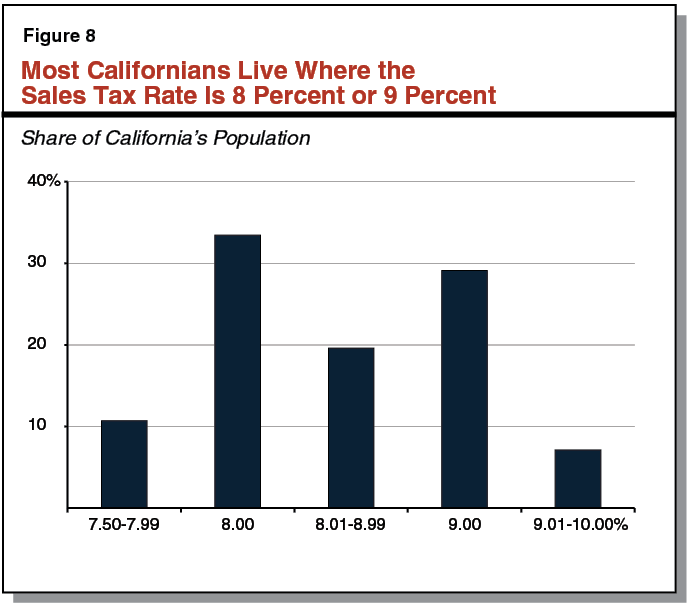

The average state and local combined sales tax in California is 8.5 percent, according to a recent report by the Legislative Analyst’s Office. The lowest rate of 7.5 percent predominates in rural counties, while the highest rates are in urban areas. Residents in eight cities in the Bay Area and Los Angeles County are currently paying a 10 percent sales tax because their counties have received exemptions from the 2 percent cap.

“AB464 is about local control and flexibility,” said the bill’s author Assemblyman Kevin Mullin, D-San Mateo, on the Assembly floor May 14. “It gives local voters the ability to raise revenue to fund important public services, including transportation, public safety and libraries. This bill is crucial, because if just one city in a county reaches the [2 percent] cap, then the entire county is precluded from having voters raise any additional taxes, hindering key transportation projects or attempts to enhance public safety.

“As a result, a flurry of legislation has been signed into law creating individual cap exceptions across the state. AB464 reduces the need for this one-off legislation by lifting the cap statewide. Please join me in granting voters the ability to raise sufficient revenue to fund public services locally in California.”

“As a result, a flurry of legislation has been signed into law creating individual cap exceptions across the state. AB464 reduces the need for this one-off legislation by lifting the cap statewide. Please join me in granting voters the ability to raise sufficient revenue to fund public services locally in California.”

There was no debate on the bill, which passed along party lines 45-31. It’s supported by California’s counties and their transportation commissions along with government employee unions.

The California Taxpayers Association issued an opposition “floor alert” on the bill that was signed by numerous business and local taxpayer organizations. It states that “California already has the highest sales and use tax rate in the country,” and provides three arguments against raising the cap:

- Increases the cost of doing business. Businesses face a significant sales and use tax burden in California, and business purchases account for roughly 40 percent of all sales and use tax collected by state and local governments. California is one of the few states that requires businesses to pay sales and use tax on manufacturing and R&D equipment bought and used in the state, making California a very expensive state to operate in, particularly when the sales tax rate is 10 percent in some California cities.

- The sales and use tax is a regressive tax that impacts California’s most vulnerable residents, making it more difficult for them to budget and purchase everyday necessities. California’s economy is improving, resulting in improved revenue collections this year. Now is the wrong time to ask taxpayers, especially those that can least afford it, to spend more of their income to pay taxes.

- Raises the sales tax rate to 11 percent in some areas. [T]he Los Angeles Metropolitan Transit Authority imposes a 0.5 percent tax in excess of current limitations for all of Los Angeles County. This bill would authorize this district to increase its rate to 11 percent. This level of taxation is excessive, and exacerbates the problems described above.

The immediate beneficiaries of AB464 are Alameda, Contra Costa, Los Angeles and San Mateo counties, which have all reached the 2 percent limit, as well as Marin, San Diego and Sonoma counties, which are near the 2 percent limit, according to the Assembly’s legislative analysis.

California’s sales tax brought in $48 billion in 2013–14. About half of it goes to the state government’s general fund, making it the second largest general fund source after the income tax, which accounts for two-thirds. One percent of the sales tax goes to cities’ and counties’ general funds; the rest is aimed at specific programs such as public safety and transportation.

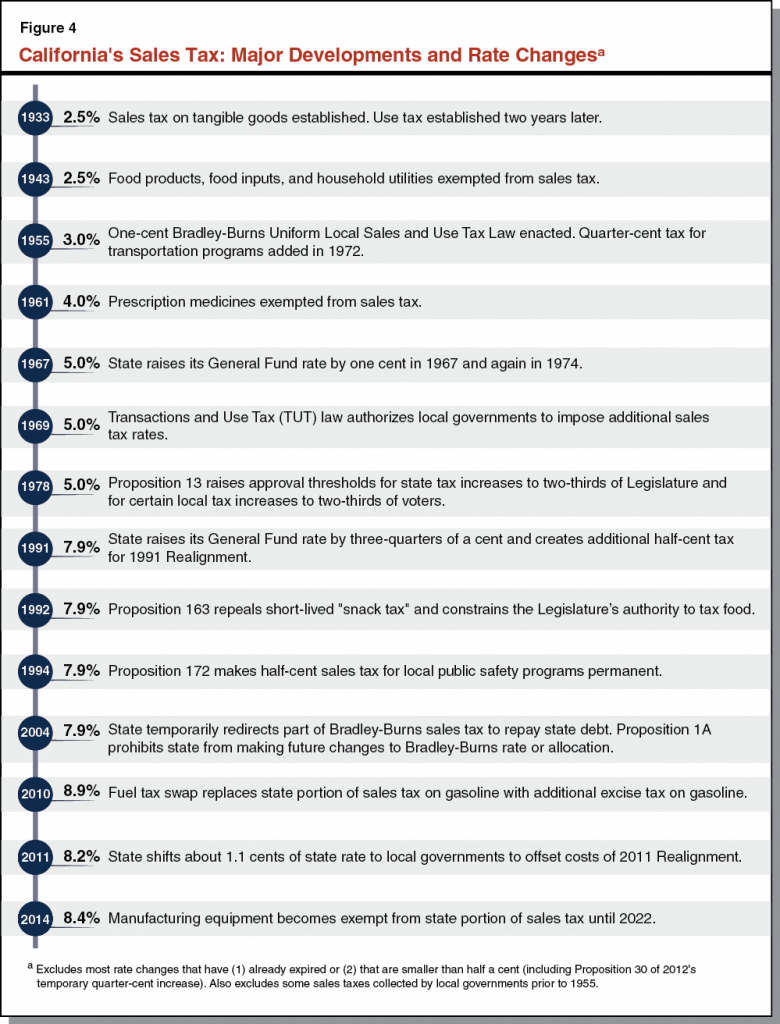

The statewide sales tax rate began at 2.5 percent in 1933. Although the tax rate has tripled since then and its revenue has increased at a 7.3 percent annual rate, the sales tax has actually decreased as a share of total state revenue. “In the 1950s, the sales tax accounted for the majority of General Fund revenue, while the personal income tax contributed less than one-fifth,” the LAO report said. “Since then, personal income tax revenue has grown rapidly due to growth in real incomes, the state’s progressive rate structure and increased capital gains.”

In 1969, cities and counties were granted the authorization to pass their own sales tax increases, mostly benefiting transportation improvements.

Although not nearly as volatile a revenue source as the income tax, revenue from the sales tax can vary significantly depending on the state of the economy. In 1974-75 sales tax revenue increased 22 percent, but in 2008-09 it declined 10 percent. Overall, however, adjusting for increased rate changes, inflation and population, sales tax revenue has remained roughly constant per capita since 1970–71, according to the LAO.

AB464 will next be considered by the Senate Rules Committee.

Related Articles

CA Legislature sends Brown microbead ban

After a roller coaster ride through the Senate, a bill enacting the nation’s toughest ban on so-called “microbeads” headed to Gov.

Few donors, big support for Prop. 47

With California’s Proposition 47, advocates of criminal justice reform have created a potent test case for national policy. But financial support for

CA GOP cheers federal support for new water bills

Central California residents, long hoping for federal water reform, have begun to see some movement from Washington. Rep. David Valadao,