Legislators make new push to gut Prop. 13

Dec. 27, 2012

By Katy Grimes

The final votes from the November election were not even counted before state Sen. Mark Leno, D-San Francisco, introduced a constitutional amendment to Proposition 13 to forever alter the landmark tax-revolt measure.

Let the debate begin.

Even after passage of Proposition 30, Gov. Jerry Brown’s $10 billion sales and income tax increase measure, Leno claimed that the state needs even more taxpayer funding for local schools.

Leno’s legislation, SCA 3, would allow local property taxes to pass with a 55 percent voter majority instead of the two-thirds majority as currently required for all tax increases in the state. “Education funding across California has been decimated in recent years, with severe consequences for students and our local schools,” said Leno in a press statement.

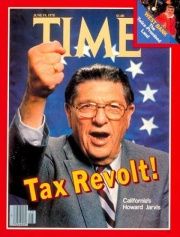

Proposition 13, the landmark ballot initiative that limited property tax increases to 1976 levels, and required a two-thirds majority to pass local measures in communities and taxes through the legislature, has been under fire since its passage in 1978.

The state’s Democrats are feeling emboldened with supermajorities in both houses of the Legislature, and Prop. 13 is their first target.

Opposition to tax limitations

Under Prop. 13, all property is reassessed in value only upon change in ownership or a sale.

Lenny Goldberg, executive director of the pro-tax California Tax Reform Association, has been a vocal proponent of assessing commercial property to at higher rates than homes. Known as a proponent of the “split-roll,” Goldberg has consistently said that, because so many commercial properties are held in limited-liability partnerships and trusts, true ownership is unclear when partners sell off ownership interest. Over time, commercial property partnerships bring in all new partners which, according to Goldberg, is an unfair way to avoid being subjected to property tax assessments.

But California Taxpayers Association Chief Consultant David Doerr says that, at the same time Prop. 13 was on the ballot in 1978, there was also a measure to split the tax roll, which voters did not approve.

Who really gets taxed

Ninety-seven percent of all California businesses are small businesses. These small businesses are always under attack because they are easy marks for tax-and-spend politicians. Small businesses don’t have high-powered, well-connected lobbyists to work special legislative deals, and take the brunt of tax, fee and utility increases.

Currently, small businesses are under a vicious assault from state government with a 50 percent increase in electric rates thanks to AB 32, California’s Global Warming Solutions Act of 2006; 15 percent higher water rates; new storm water taxes in Los Angeles County; and an Obamacare surcharge of $5,000 to $8,000 per employee, according to CalWatchdog.com’s Wayne Lusvardi. Eliminating Prop. 13 would be just another nail in the coffin for struggling small business.

Under a split-roll tax, residential properties would continue under the system outlined by Prop. 13. But commercial properties would be reassessed at least every three years.

Opponents of tax limits like Goldberg, Brown and Democratic lawmakers continually say publicly that big corporations get away without paying their “fair share” of property taxes. It’s a common theme today in politics. But any decent lawyer will admit that just changing title on property is not considered a legal ownership transfer under state law.

And since 1978, all legal challenges to this have been overturned by higher courts of law, according to Jon Coupal, president of the Howard Jarvis Taxpayers Association. Coupal said that Prop. 13 has been one of the most adjudicated laws in the history of the state, yet continues to hold fast.

There’s a myth that property taxes disproportionately fall on homeowners instead of commercial property owners. But the California Business Property Association found that the opposite has happened.

“Using data obtained from the California Board of Equalization, we calculated the disparity between assessed value and market value for two classes of property: owner-occupied residential, and commercial/industrial. We found that the assessed-value-to-market-value ratio for owner-occupied residential property in the 2006-2007 roll was 53 percent, while the ratio for commercial and industrial property was nearly 60 percent.”

In other words, commercial and industrial property is being assessed for tax purposes at values that are closer to market values than is the case for owner-occupied residential property.

Politics and Prop. 13

When control and government expansion are the real goal, the facts and politicians don’t always get along.

CalTax and the Howard Jarvis Taxpayers Association warn that, if the Legislature splits the tax roles and commercial property is taxed at whatever rate politicians claim they need, large employers will flee the state, while small employers and businesses, which can’t afford to move, will be burdened with unsustainable tax increases.

Prop. 13 does not shift the property tax burden to homeowners. “The assessed value on non-homeowner property subject to Prop. 13 has grown an average of 8.5 percent per year, while homeowners’ property tax has grown an average of 8.3 percent,” reports CalTax. “Thus, the Prop. 13 property taxes paid by non-homeowners have outpaced homeowners’ property tax burden. In fact, Prop. 13 has prevented a property tax shift to homeowners.”

What will be the result of this next round of attacks on Prop. 13? Only the data over the next two years will really tell.

Related Articles

Does Budget Forum Portend Tax Hikes?

DEC. 9, 2010 By KATY GRIMES In what appeared to be an event designed to prepare California for tax increases,

Fear Tactics Dominate Budget Hearing

APRIL 15, 2011 By KATY GRIMES “Cuts to the California dream” are coming, California Superintendent of Schools Tom Torlakson warned